Getting My Guild Mortgage - Mortgage lender and advisor for home loan To Work

Greater Nevada Credit Union brokers first ever USDA CARES Act loan (sponsored)

Everything about Homeownership Assistance: Nevada - HUD

Qualifying candidates receive a personalized grant with various loan types, including FHA, VA, USDA, or the Fannie Mae HFA Preferred Conventional loan. All House at Last loans are 30-year, fixed rate mortgages, and the grants do not need to be paid back.

When it's time to buy your very first home, there's plenty to consider, and where you choose to buy is very important. I Found This Interesting draws locals thanks to industries including aerospace and defense, video gaming and tourism, mining and natural resource management. It's the seventh-largest state by landmass, though only around 3 million people call The Silver State house.

Little Known Facts About Homeownership Assistance: Nevada - HUD.

When it pertains to buying your very first house, the Nevada Housing Division can be an important resource. The agency was produced by the state in 1975 to assist low- and moderate-income households and people secure affordable housing. Here's what you require to know about the company's programs for newbie property buyers.

Among the Home Is Possible programs is a mortgage particularly for first-time property buyers, which features deposit support of as much as 4 percent of the total loan amount as a second home mortgage, forgivable after 3 years (so long as you remain in the house). A first-time buyer is somebody who has actually not owned a home in the past three years.

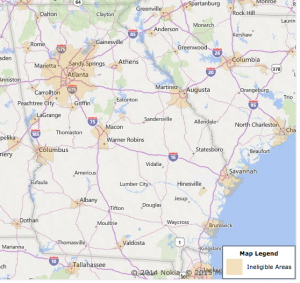

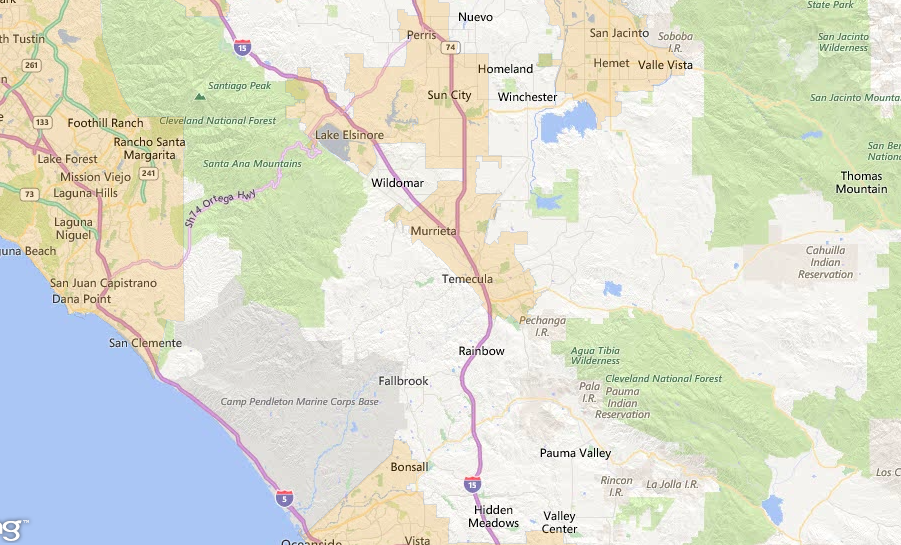

Nevada City, California Property Eligibility Search for a USDA Home Loan

USDA approves loan to build new Virginia City water tanks - Serving Carson City for over 150 years

The smart Trick of USDA loan offered to low-income buyers in rural Nevada That Nobody is Talking About

Customer requirements: 660 minimum credit history Optimum 45 percent debt-to-income ratio Should complete free property buyer education course (offered online) Need to satisfy NHD earnings limits, which depend on county; the most affordable limit is $75,000 for two or fewer people in Churchill, Clark, Esmeralda, Lincoln, Lyon, Mineral, Nye, Pershing and White Pine counties, and the highest limitation is $119,600 for 3 or more individuals in Eureka County Must pay one-time fee of $755, due at closing Property requirements: Should be a single- or two-family home, condominium, townhome, made house (except with Freddie Mac); can also be a four-unit home if you reside in one of the units as your primary residence Must remain in Nevada Should be a main residence Should meet NHD purchase rate limitations, which differ by county and range from $294,601 to $408,477 NHD House Is Possible Program, Aside from the first-time homebuyer home loan and support used through Home Is Possible, the NHD also provides first-time and repeat purchasers a similar mortgage and deposit support by means of the program, approximately 5 percent of the overall loan amount.